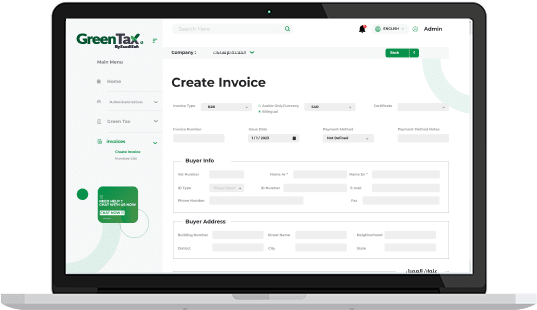

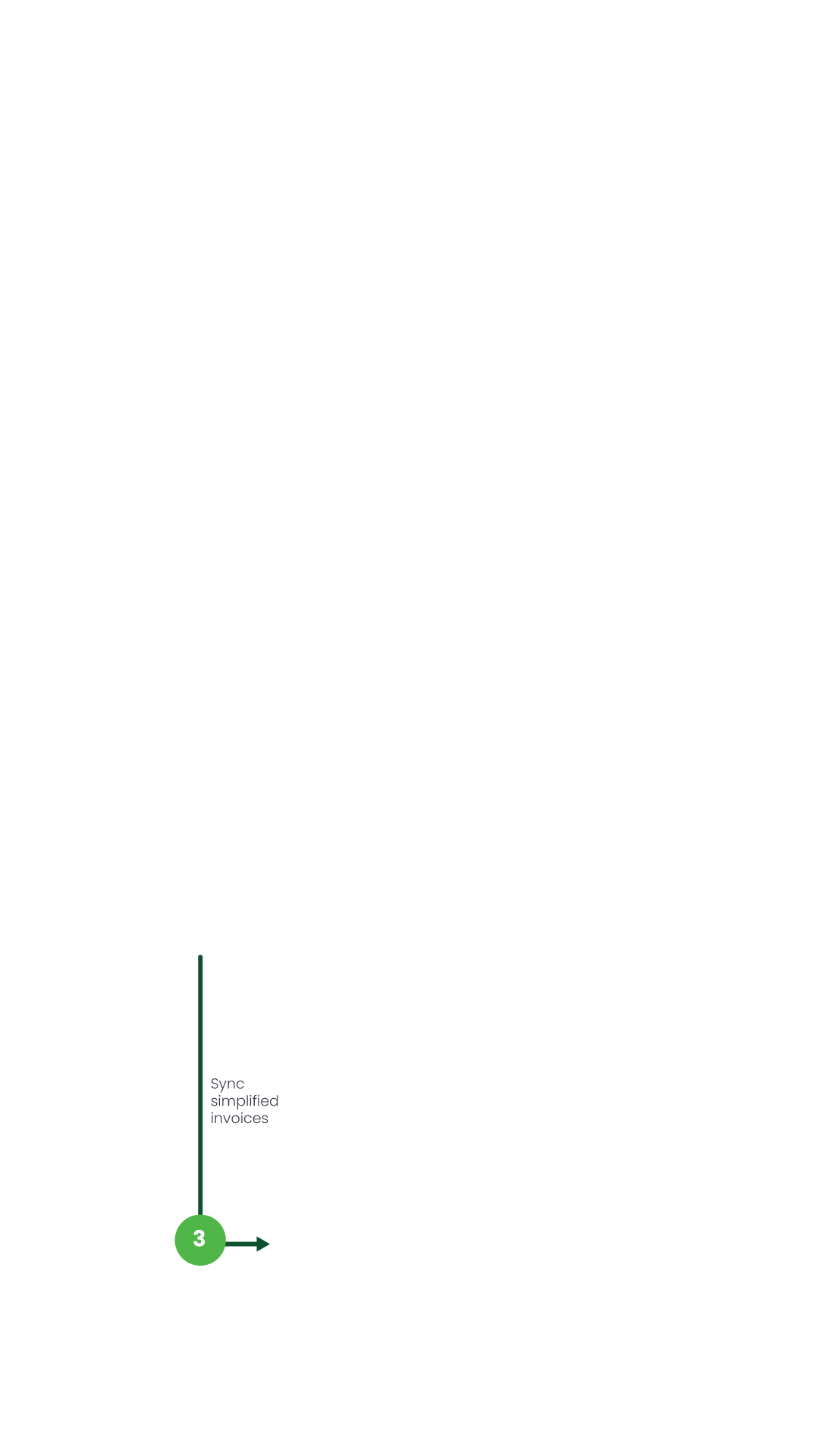

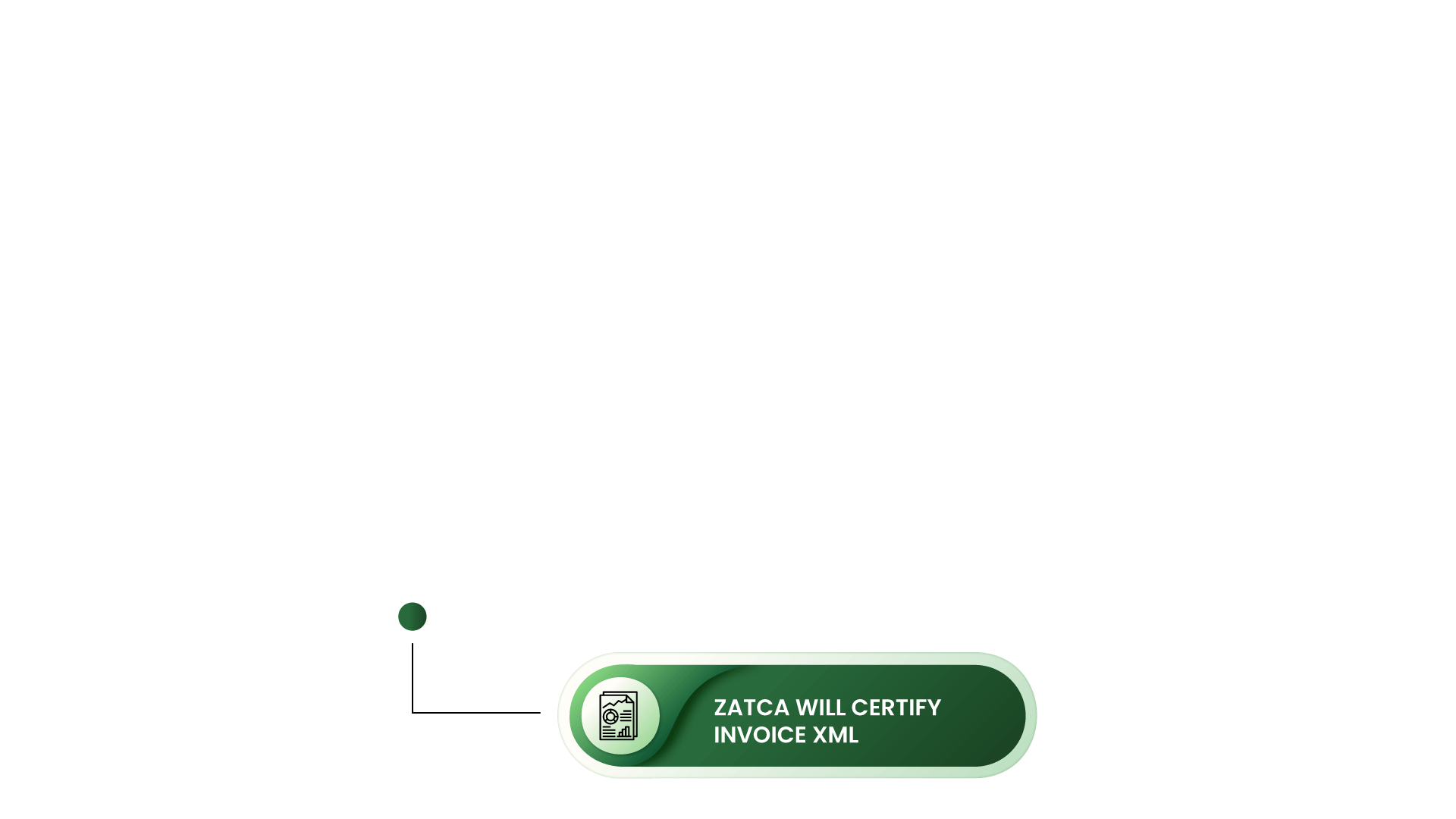

Compliant with ZATCA regulations

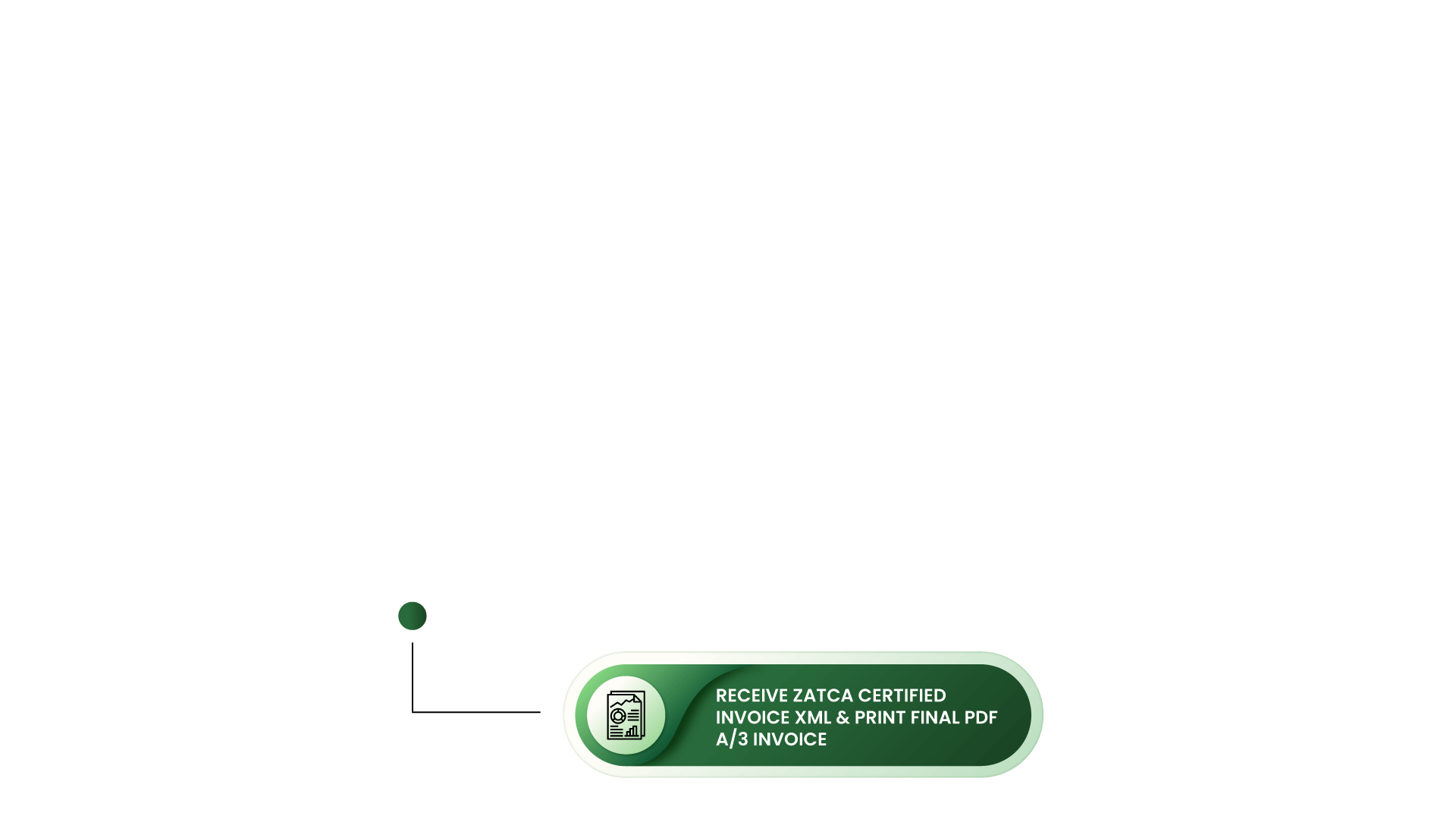

- Data hosted & archived on KSA cloud servers

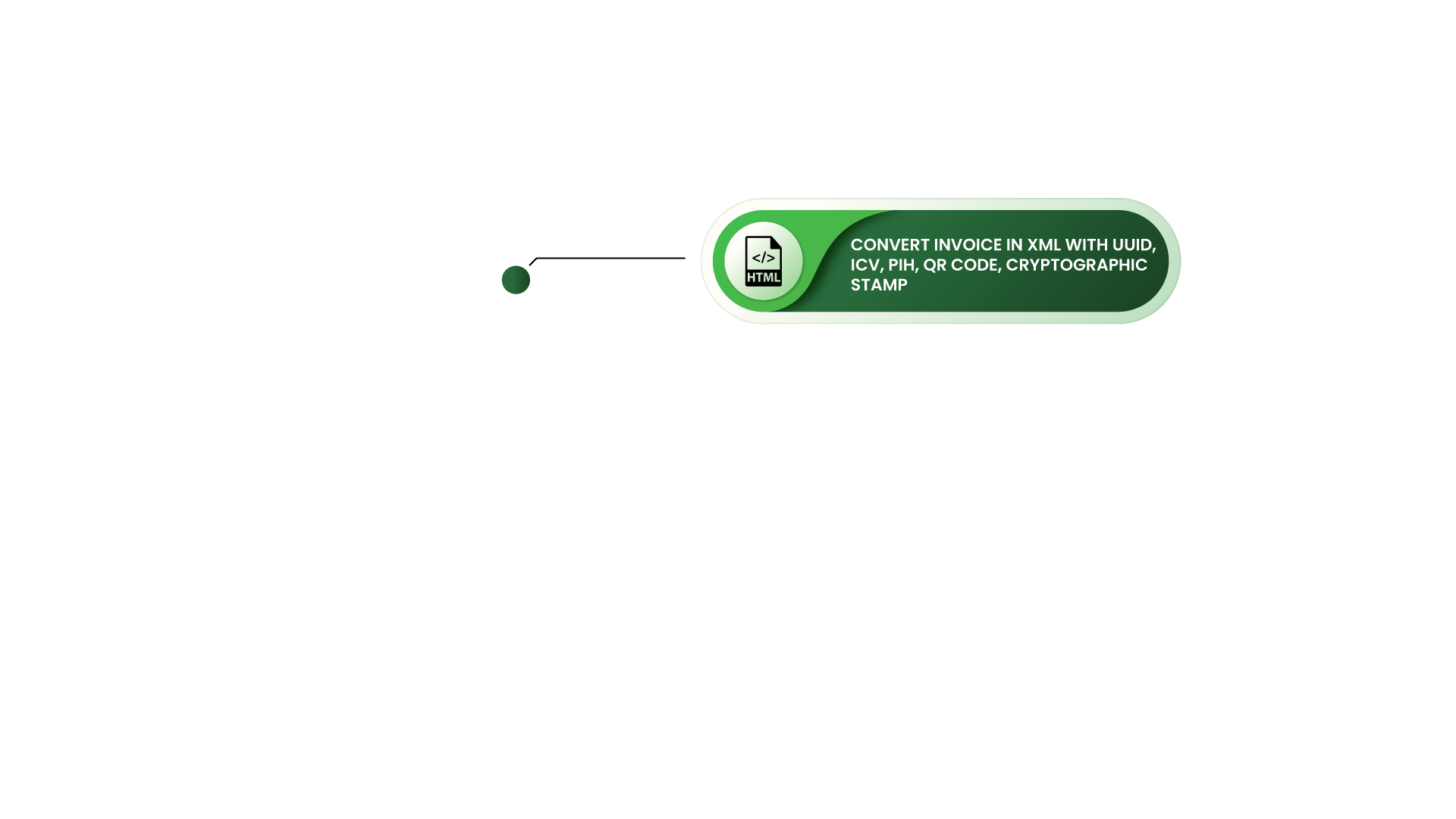

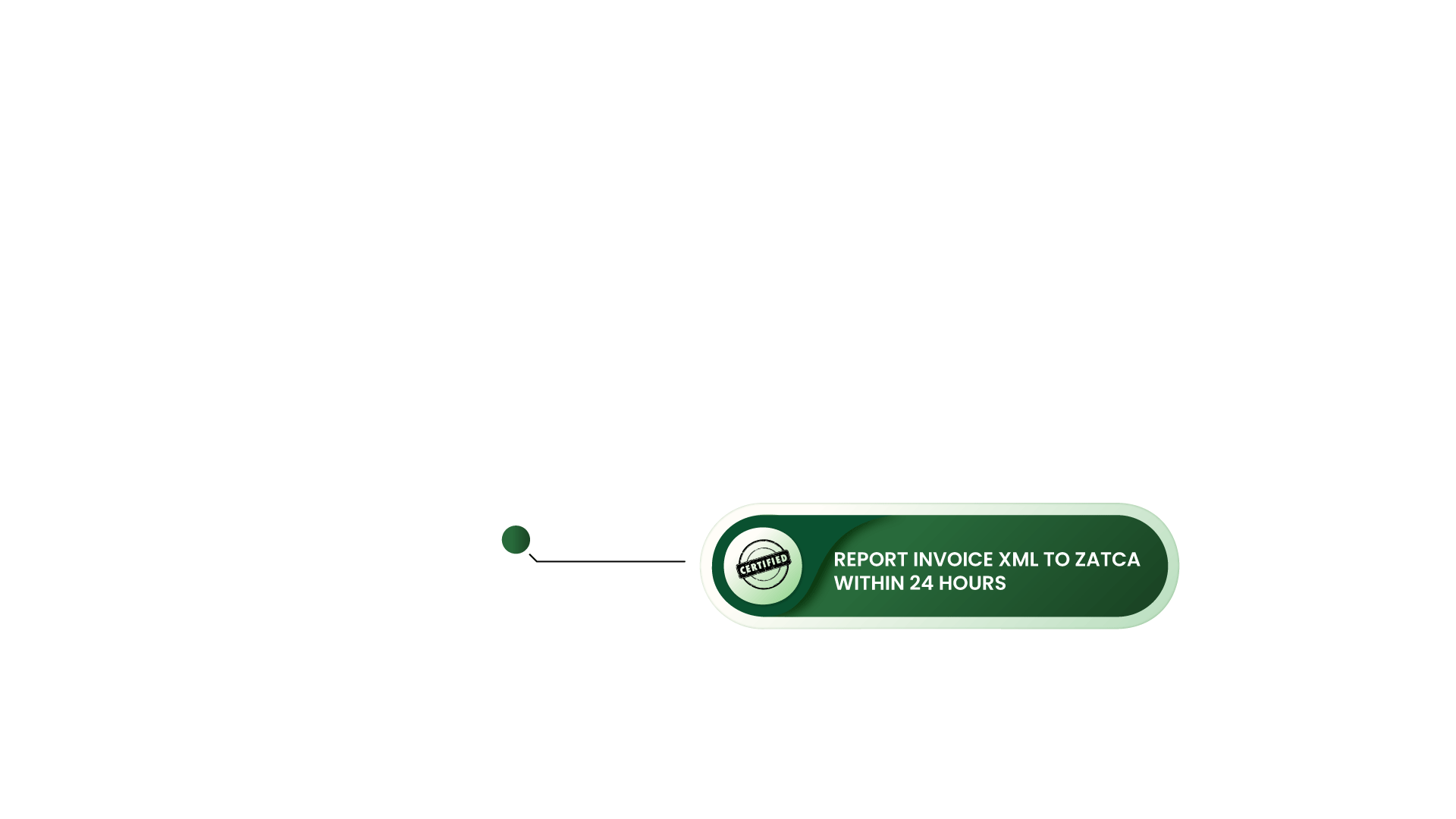

- Software ready for all waves of ZATCA

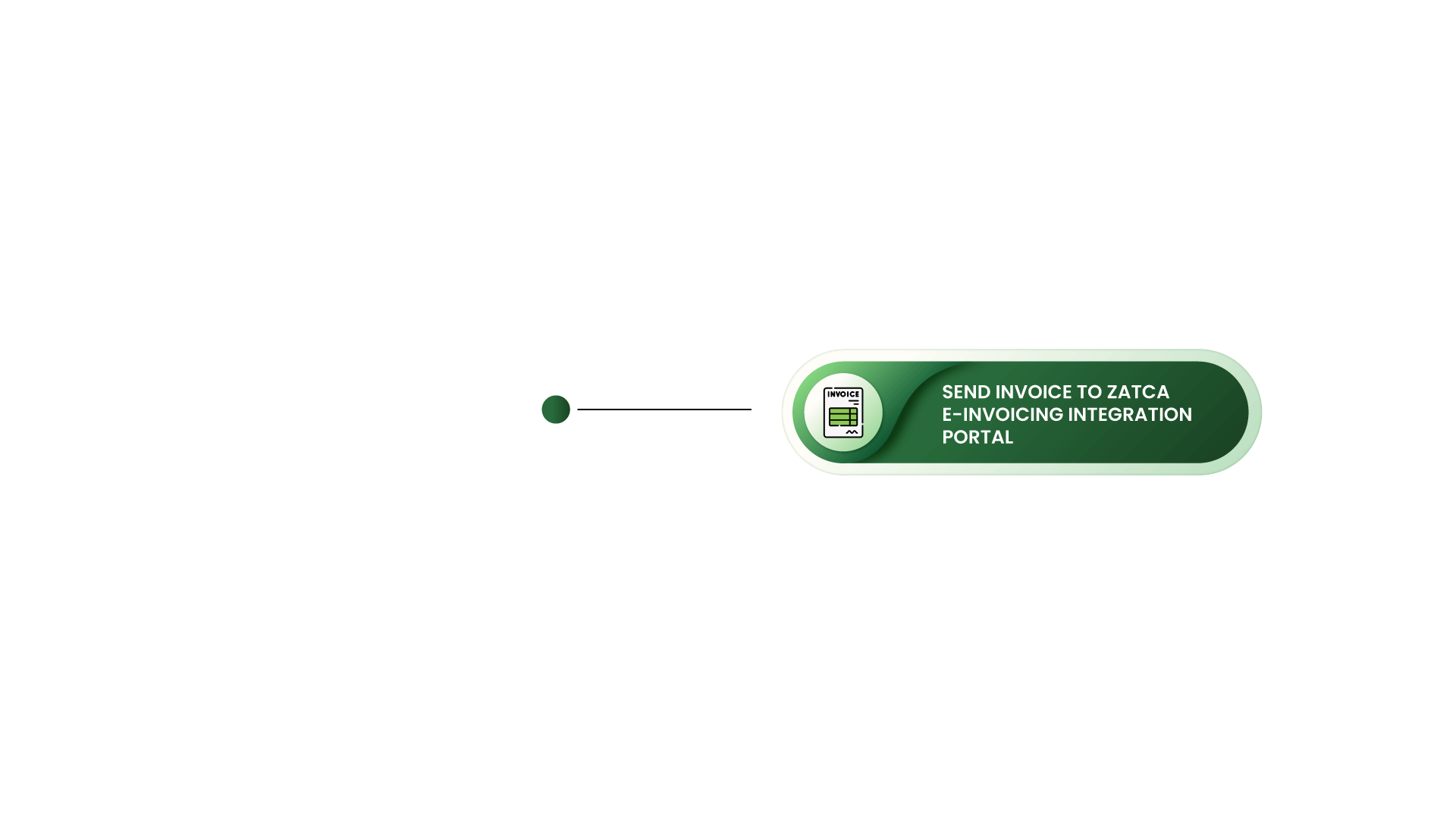

We help ALL business enterprises become 100% ZATCA compliant by ensuring seamless integration with your system, minimizing the need to change your current workflows.

Dedicated local account manager & advisory services inside Saudi Arabia

Supports multiple E-Invoicing systems and our in-house team ensure a seamless process

Advanced user access and legal archving in Saudi Arabia

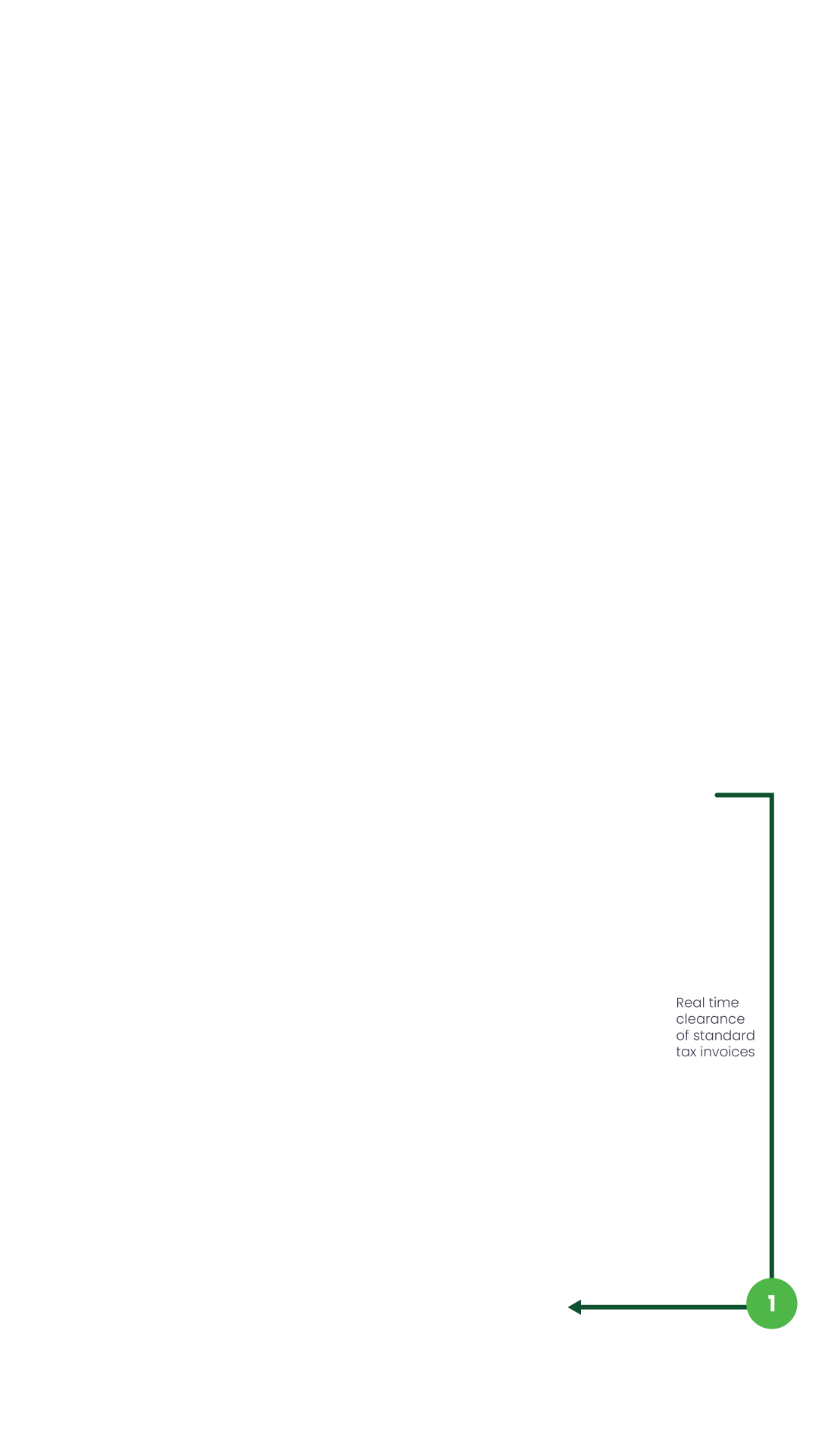

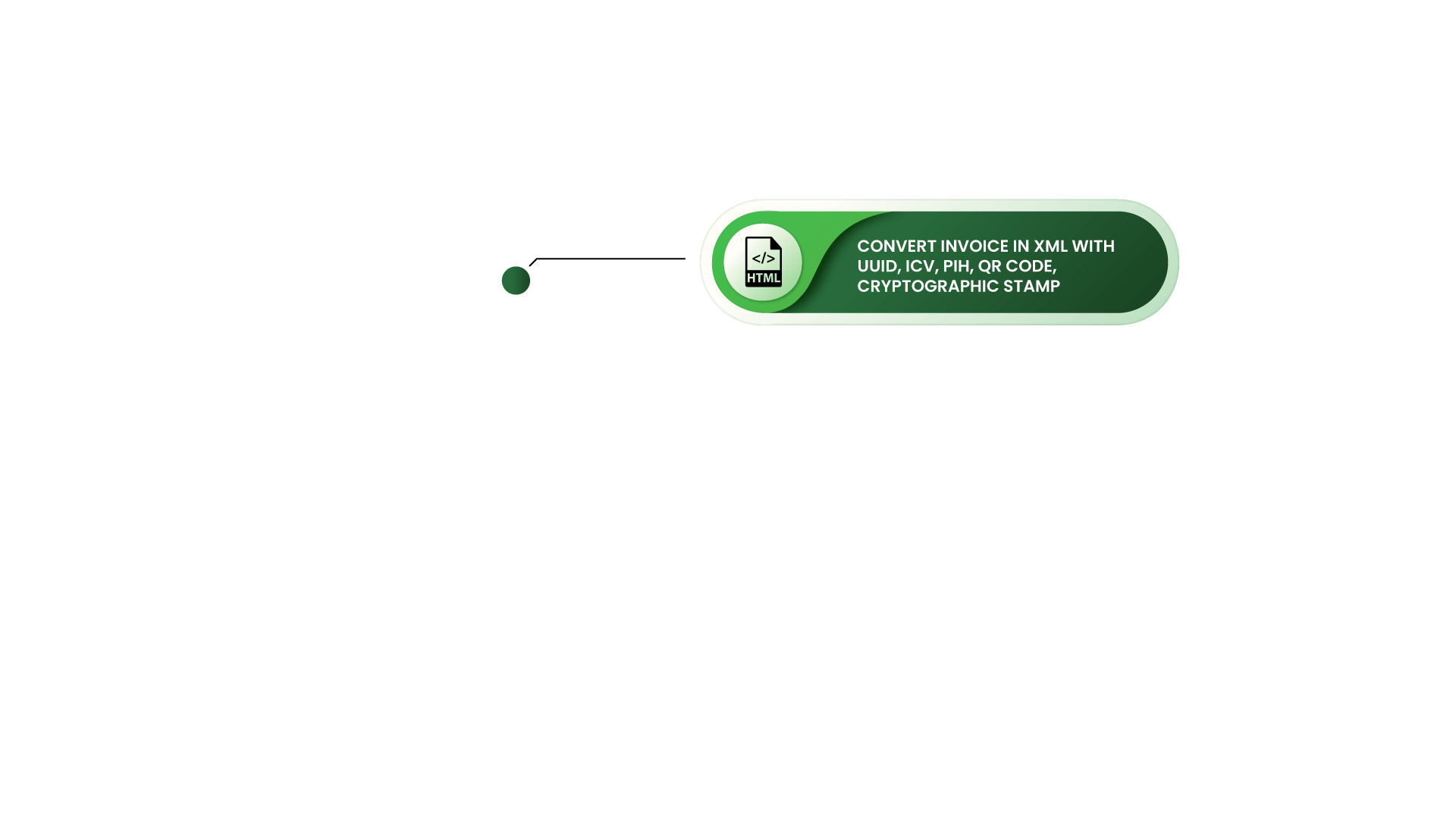

- B2B invoices issued by the supplier

- Debit notes issued by the supplier pertaining to B2B invoices

- Credit notes issued by the supplier pertaining to B2B invoices

- Occasional documents that could be required by ZATCA

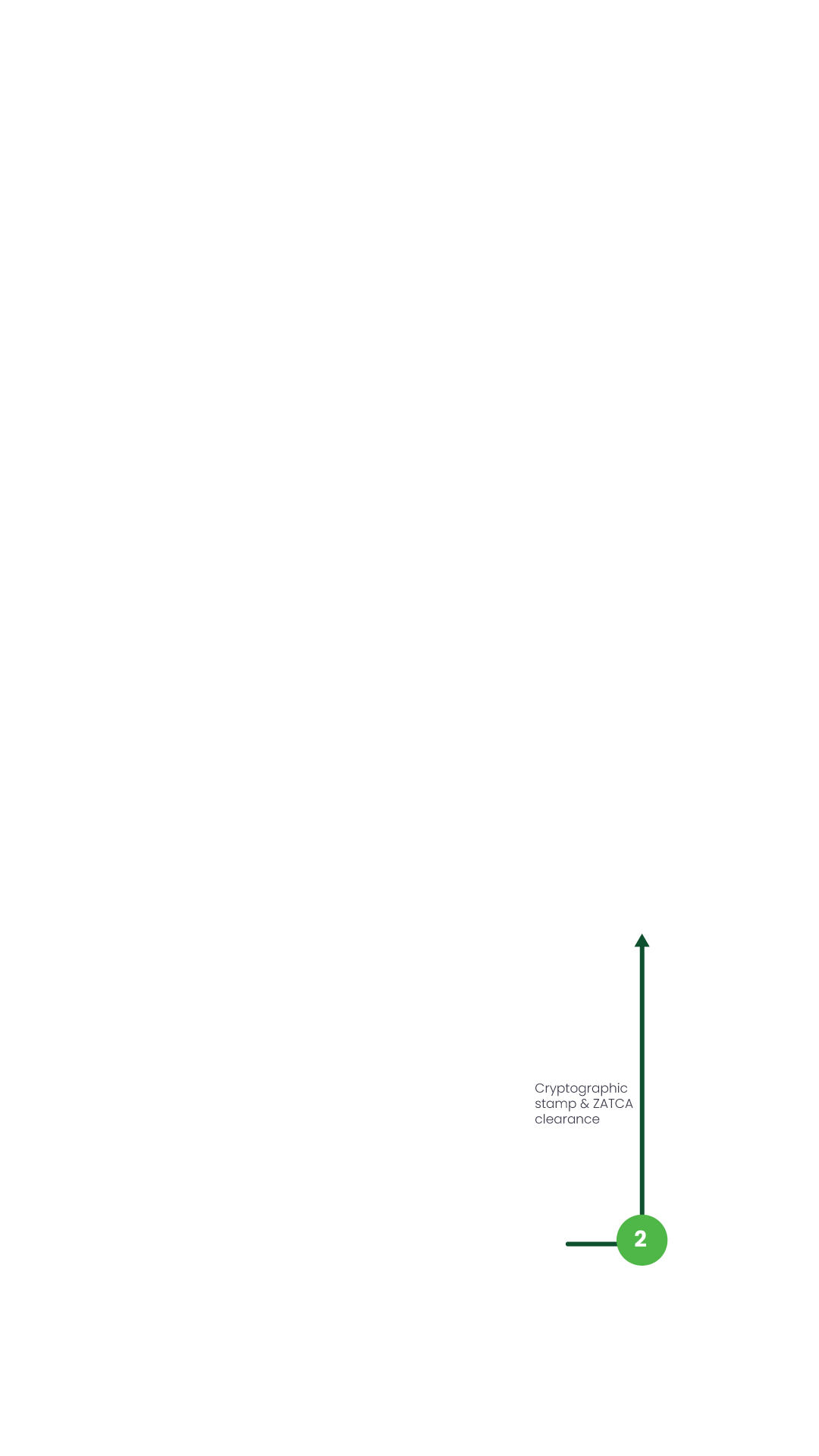

No. With machine readability the QR code will enable easy validation of the contents of an E-Invoice.